Payments Reimagined

Reshaping how professionals get paid — and setting the stage for the future of LawPay, CPACharge and AffiniPay for Associations.

My Role

As Senior UX Designer, I:

-

Drove the UX strategy and vision for the unified flow

-

Conducted and synthesized deep user research

-

Led cross-functional design workshops with product, engineering, and support

-

Created prototypes and concept testing for internal and external validation

-

Advocated for a cohesive long-term design system that could scale with the platform

Background

AffiniPay powers payments for professionals across legal, accounting, and other service industries. Over time, LawPay—the flagship legal payments product—had accumulated a suite of overlapping features: QuickBill, VT Charge, Scheduled Payments, Payment Pages, API integrations, and mobile apps.

In 2020 alone, over $3.4B in payments were processed across nine different tools—each requiring different entry points, decisions, and mental models. While each tool worked well individually, users were overwhelmed by the number of options and unclear about when to use which one. The result: confusion, inefficiency, and frequent support tickets with users struggling to answer one basic question:

"Which feature should I use to get paid? 🤔"

So, we set out to simplify the experience and reduce the friction.

The Problem

The existing tools forced users to make upfront decisions about things like:

-

Who’s entering the payment info—me or my client?

-

Is this a one-time charge or part of a schedule?

-

Which feature supports the options I need (like surcharge, attachments, or saved payment methods)?

Users had to navigate this complexity without clear guidance—and without visibility into how the different features related to one another. Many defaulted to outdated or inefficient habits simply because it was what they knew.

The Goal

Design a unified payment experience rooted in real user intent instead of internal feature boundaries—while laying the groundwork for long-term product evolution.

Research-Driven Insights

We conducted extensive customer interviews and journey mapping, surfacing key use cases that weren't well-supported:

-

Add surcharges to QuickBills and scheduled payments

-

Let clients pay in multiple installments

-

Add custom fields or attachments to requests

-

Generate reusable payment links

-

See what was sent to clients and when

This research highlighted the core actions users wanted to take:

-

Charge a card

-

Send a payment request

-

Set up a payment plan

And two main execution paths:

-

Enter the info themselves

-

Let clients enter info (for better compliance and flexibility)

We realized it wasn’t about adding more features. It was about simplifying the decision-making.

The Vision

We designed a reimagined Payments experience that guided users through a single, flexible flow—whether they were charging now, requesting later, or setting up recurring payments.

Key Concepts

🧭 Request vs. Run

Let users decide whether to collect payment info, run a charge or allowing their clients to enter their own info, without picking the "right feature" upfront.

🔗 Custom Link Requests

Allow users to create payment links they can send via their own email systems, allowing them to get paid without deviating from their existing workflow.

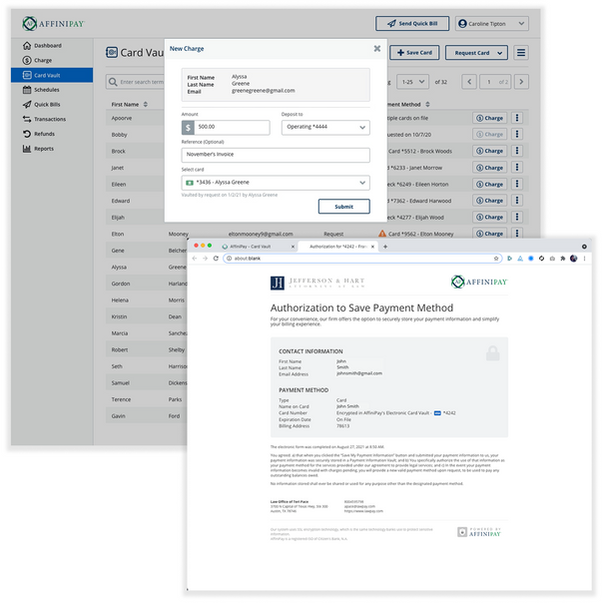

🔐 Card Vault Integration

Search, reuse, and auto-fill client information and saved payment methods, speeding up workflows and reducing errors.

📎 Support for Attachments & Custom Fields

Enhance QuickBills and scheduled payments with file attachments and custom fields (features often requested by law firms handling complex billing).

And most importantly:

📂 New Payments Section

Consolidate all types of payments (QuickBills, Schedules, VT Charges) into one cohesive view, not buried in different sections of the product.

What We Delivered

While the full "Payments Reimagined" concept wasn’t implemented at the time, the research and design vision directly influenced major future product work, including:

-

The launch of the Card Vault — now a core component of the platform

-

Improvements to scheduling workflows that made recurring payments easier

-

The Unified Payment Flow, released after this work, which adopted many of these patterns

-

The 2025 LawPay Replatform and Redesign, which embraced the intent-based flow we originally proposed

Impact

This project wasn’t just about simplifying payments—it was about setting a new standard for how we design across AffiniPay. By centering on user mental models instead of feature silos, we created a blueprint that influenced years of product development.

Even though the original vision wasn’t immediately built, our insights proved foundational. The 2025 LawPay redesign echoes the core structure and ideas from Payments Reimagined—evidence that thoughtful research and strategic design can have lasting ripple effects.

Reflections & Learnings

🧠 User understanding is more valuable than feature parity

Instead of building more, we needed to reframe what already existed in a way that aligned with users’ real mental models and day-to-day needs. That shift in thinking (from feature delivery to clarity and cohesion) became central to how I approach product design.

🌱 Great design work sometimes plants seeds

The research, artifacts, and design patterns we created continued to influence the product roadmap for years. It taught me to embrace the long arc of design influence and that thoughtful, user-centered work can have a delayed but powerful impact.

🔍 Research doesn't always lead to answers, it can also help reframe the questions

At the start, everyone wanted to know “What’s the best payment feature we should invest in?”, but after dozens of interviews and user testing sessions, we shifted the conversation to, “Why do users have to make that choice at all?”. That reframing changed the entire trajectory of the work. Sometimes the biggest design win is changing what question the team is trying to solve.

🧭 Designing with longevity in mind matters

I was deliberate about creating reusable UX patterns and design decisions that could evolve with the product, not just solve for a one-off moment. Thinking systemically helped ensure that even if the full flow wasn’t built immediately, individual components could be adopted into the platform in ways that made sense over time.

In Conclusion

I’m incredibly proud of the work we did on Payments Reimagined, not just for the design itself, but for the foundation it laid. It shaped key elements of the product roadmap and helped shift how we think about user intent across the platform. Years later, it’s especially rewarding to see that impact reflected in the bigger picture: in 2025, AffiniPay was named one of CNBC’s Top Fintech Companies in the World, in the Payments category, alongside industry giants like Visa and Stripe, and received the G2 Award for Best Usability in the Best Legal Software Products Category.

Being part of the work that helped get us there is one of the highlights of my career.